6 Key Financial Priorities for

Online Entrepreneurs

Guest blog provided by Sufio

We’re not exaggerating when we say financial management can make or break your business. Studies show us that 82% of small business failures are actually caused by poor cash management.

With that in mind, this article guides online entrepreneurs through the 6 most important priorities for managing their finances and tax management.

Our advice is not exhaustive by any means, but following these elementary principles will ensure that your online business stays in good financial health for the foreseeable future.

Establish clear financial protocol

As someone who owns a small online business, you probably don’t need lots of formal processes for every little thing. However, when it comes to financial management, it’s important to have clear protocols.

This is because as your business grows and you hire more employees, your finances will inevitably become more complex. Maintaining proper oversight can no longer be taken for granted at that point.

This means that if you don’t, for example, have protocols like dedicating a set amount of hours each week to review your books, the risk of mistakes in your accounting going unnoticed increases.

Therefore, having a system that promotes transparency, accuracy, and accountability in your financial management will act as a safeguard.

Get paid on time

Ensuring that your small online business gets paid on time is crucial for maintaining a healthy cash flow.

Unless you’re an ecommerce company that receives payment before delivering its products, late payments are likely to be one of the biggest financial risks you face. According to one survey, almost 50,000 UK businesses are bankrupted every year by late payments.

You can prevent the financial nightmare of perennial late payments by adopting strategies like:

- Being clear upfront about your payment processes

- Asking for deposits prior to beginning any work

- Using efficient invoicing processes

- Building strong relationships with clients or customers

- Charging interest on late payments

Track and monitor

Despite being so important and so basic, failing to track and frequently review all aspects of business finances properly is a common error.

Closely monitoring your income and expenses, and ensuring that everything has been recorded accurately, is essential for generating up-to-date profit and loss statements that tell you exactly how you’re performing.

What’s more, accurate financial tracking is essential for taxes. In particular, failing to record expenses accurately is a key tax compliance mistake in this area.

Properly documenting and categorizing expenses not only allows you to file your taxes smoothly but also helps you maximize deductions and reduce the risk of potential audits.

So no matter how small or straightforward your business’s finances are, make absolutely sure you stay on top of everything from bank reconciliations to outstanding invoices.

Plan and budget

Proactive planning and budgeting are vital for navigating the complex financial landscape and ensuring that you meet your financial goals.

Thinking ahead and producing forecasts, such as breakeven analyses and cash flow statements, allows you to set clear financial objectives and make key decisions more strategically.

Creating a formal budget is also essential, as it allows you to prioritize your expenditure and ensure that it doesn’t accidentally spiral out of control.

Planning for taxes well before filing deadlines is also crucial to avoid being blindsided by higher-than-expected tax bills, or even hit with penalties. This way, you can optimize your tax burden while staying compliant.

Invest in the future

Investing in future growth is a great way to achieve sustainable, long-term success as an online business.

For example, hiring a talented employee with specific skills or spending on a new tech stack could allow you to improve your product offering, creating value and helping to grow your business.

On another note, it’s important for small businesses to evaluate the return on investment (ROI) of their expenditures and adjust spending accordingly.

The importance of spending money to make money is supported by many studies—such as this one from McKinsey—demonstrating that businesses that invest for the long term are more successful than those that don’t.

Use automation software

Our final piece of advice is to streamline your financial management by taking advantage of the most innovative automation software.

Up-to-date accounting software offers several game-changing benefits, including:

- Saving time by automating administrative tasks

- Reducing costly errors

- Making your financial data easy to retrieve and analyze—and harder to misplace

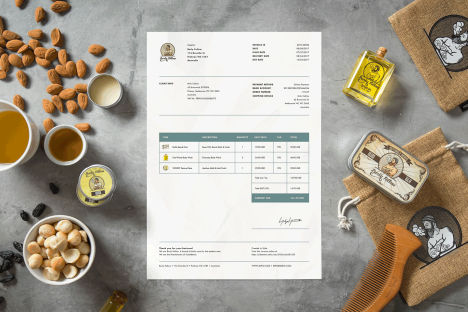

If you’re an online business looking for software that will make invoicing easier and faster, we recommend Sufio—a professional invoicing app for Shopify.

Sufio automates:

- Creating invoices from orders, credit notes from refunds, and invoice reminders for customers;

- Displaying invoicing documents in the correct currency and language

- Sending invoices by email

Try 14 days of Sufio for free and see how our automation features make handling your invoicing a much smoother process.

Sources

- https://www.aabrs.com/managing-small-business-finances/

- https://www.businessnewsdaily.com/5954-smb-finance-management-tips.html

- https://www.fundera.com/blog/small-business-statistics#source